What Are Corporate Bonds, How Do They Work, and What Are Their Benefits?

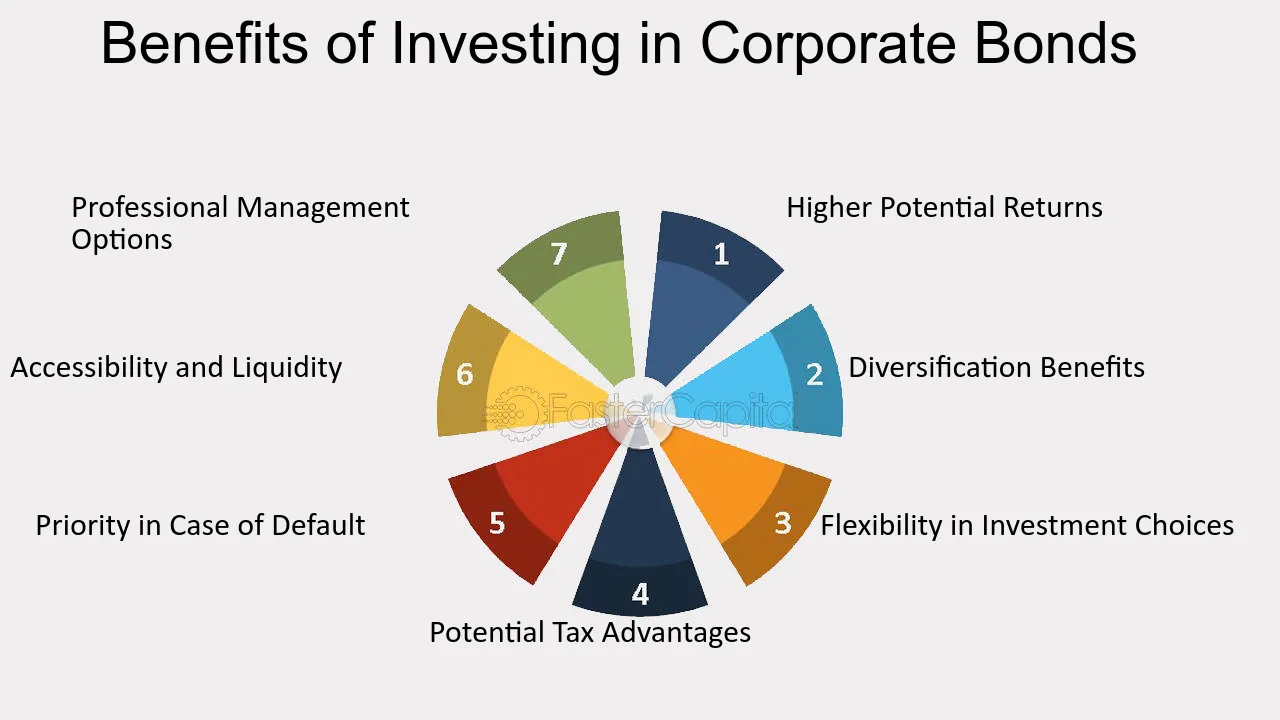

Corporate bonds play a crucial role in the world of finance and are preferred by individual and institutional investors. Portfolio diversification is the number one rule of investing, and corporate bonds help investors achieve the same. They offer a lucrative opportunity for investors to earn higher, fixed returns than fixed deposits while maintaining capital security compared to stocks.

Investing in corporate bonds has become easier thanks to new guidelines from authorities like SEBI (Securities and Exchange Board of India), making it more accessible to retail investors. Previously, retail investors could not enter this market due to the high ticket size of the investments. The face value of debt securities issued through private placements has been reduced from INR 1,00,000 to INR 10,000. This change makes fixed-income investment easier and smoother for retail investors.

This article will examine corporate bonds, how they work, why they are an intelligent addition to any investment portfolio, and provide insights into how one can invest in them.

What Are Corporate Bonds?

Companies issue corporate bonds as debt instruments to obtain additional capital for expansion and operations. These bonds are sold to investors, allowing them to earn fixed returns through periodic (monthly/quarterly/annual) interest payments.

Corporate bonds are a form of security that can generate cash flows in the future and are backed by the assets of the company. Corporate Bonds in India are credit-rated from AAA (highest safety) to D (lowest safety) according to creditworthiness by credit rating agencies like CRISIL, ICRA, CARE, etc. Higher-rated bonds may offer lower yields but carry minimal default risk and vice versa.

Investors looking for higher returns than fixed deposits (FDs) and lower risk exposure than stocks are increasingly turning to corporate bonds. With the right strategy and proper research, they can be an integral part of any investor’s portfolio. Corporate bonds provide steady returns while offering better liquidity than other investments, such as real estate. A comparison of corporate bonds vs. other asset classes is depicted below:

Key Features Of Corporate Bonds

- Fixed Income: Corporate bonds offer a fixed rate of return, making them attractive to investors seeking a predictable income stream.

- Diversification: Investing in corporate bonds helps diversify an investor’s portfolio, a different asset class not directly correlated with the stock market.

- Credit Quality: Credit rating agencies assign ratings to corporate bonds based on the issuer’s capacity to fulfill its debt obligations. It makes it possible for investors to evaluate the creditworthiness of potential investments and make decisions based on risk.

- Maturity Dates: Corporate bonds have specific maturity dates, assisting investors in planning for future expenses, such as higher education or retirement.

- Potentially Higher Returns: Corporate bonds offer higher returns than government bonds and fixed deposits at a slightly higher risk.

- Inflation-Hedge: Corporate bonds can be used to protect against inflation, currency fluctuations, and changes in interest rates.

Rate of Coupons and Yield to Maturity

The coupon rate is the annual interest rate bond issuers pay on the bond’s face value. For example, if you have a 5-year, INR 1000 face value bond with a coupon rate of 10%, you will earn INR 100 every year for five years.

Conversely, yield to maturity (YTM) is the return rate investors hold while holding the bond until maturity. The yield to maturity becomes relevant only when an investor purchases the bond from the secondary market.

The bond yield to maturity can be calculated using the following formula: Let’s understand with the help of an example. An investor has a bond with a face value of INR 1000 and a coupon rate of 10%. Let us assume that the bond currently trades on the market at INR 920. The yield to maturity of such a bond will be 12.08 percent if the bond has five years to maturity and interest is paid semiannually.

Investing in Corporate Bonds in 2025 In 2025

Corporate bond investing will remain an attractive investment opportunity for moderate risk-averse investors. Indian and international trends point to continued growth in the demand for corporate bonds owing to the safe and reliable nature of the asset with a potential for higher returns.

Recently, the Fed has given dovish comments with the signal of three rate cuts in the calendar year 2024, and economists feel RBI will follow suit, giving rate cuts probably starting mid-2024. The best time to take advantage of attractive coupon rates is at a time when bond yields and interest rates may be at their highest. Overall, it indicates solid prospects, resilience, diversification, and attractive valuations for bonds compared with equities.

How Does The Bond Market Work?

The bond market, also known as the debt or fixed-income market, plays a vital role in our economy by providing a way for companies and governments to raise capital and investors to earn income while managing risk. It is a financial market where investors can buy and sell bonds issued by a company or government. Several factors, including the issuer’s creditworthiness, interest rates, bond maturity and prevailing market conditions, determine the bond’s market price.

An important thing to understand about the bond market is that bond prices and interest rates have an inverse relationship. When interest rates go up, bond prices go down. Conversely, when interest rates go down, bond prices go up.

Identifying A Good Corporate Bond Option

Corporate bonds provide stability and a steady income stream, making them an attractive option for long-term investments. But with so many different types of corporate bonds available in India, how do you know which strategy best suits your investing goals?

Here is a step-by-step process to identify a good corporate bond option:

- Know Your Needs: Assess your financial goals, needs, and risk-bearing capacity before choosing corporate bonds.

- Evaluate Risk Tolerance and Time horizon: Investment-grade corporate bonds have lower yields but provide better risk coverage than high-yielding bonds. In a similar vein, long-term bonds have higher yields than short-term bonds.

- Understand Liquidity: Some bonds can be sold quickly if you need access to your money, while others may be illiquid and redeemed only upon maturity.

- The Issuer’s Creditworthiness: Rating agencies provide helpful information about an issuer’s ability to pay back its debt obligations and can help you determine if a bond is worth investing in. While self-research may be time-consuming and difficult for laymen, specific investment discovery platforms like Grip Invest provide comprehensive financial health details of the bond issuers.

- Tax Implications: Bonds may be subject to capital gains or income tax depending on the type of bond and the duration. These investments’ post-tax profits should be accounted for by investors. Finding a good bond option requires careful consideration of all these factors. You can maximize your returns and make well-informed decisions by researching your options. Investing in bonds is not without risks, but the proper strategy increases the chances of earning better yields.

Investment Grade Bonds Vs. Bonds with High Yields Corporate Bonds come in various forms, largely falling under the high-yield bonds and investment-grade categories. Companies issue investment-grade bonds with higher credit ratings with a solid financial standing. Although these bonds have a lower yield, they are less likely to default. They are appropriate for cautious investors looking to preserve their wealth and generate a steady income.

In terms of their characteristics and dangers, high-yield corporate bonds differ from investment-grade corporate bonds. Default is more likely since the company issuing these bonds has weaker credit ratings. The following are some essential qualities and dangers connected with high yield:

- Higher Yields: High-yield bonds have higher coupon rates than investment-grade bonds. In order to make up for the increased risk of default that these bonds carry, investors receive higher interest rates.

- Low Credit Ratings: Companies issuing high-yield bonds have lower credit ratings, which raises the chance of default. These businesses could be in unstable industries or have weaker financial standings and cash flow.

- Liquidity Risk: High-yield bonds may have smaller trading volumes and less liquidity in the secondary market than investment-grade bonds. Due to this, it could be challenging to sell the bonds at profitable rates or during volatile market conditions.

How To Invest In Corporate Bonds?

Investors can invest in corporate bonds through one of the following methods:

Direct purchase of bonds from the issuer

Through Online Bond Providing Platforms (OBPP)

Through Mutual Funds

Through Electronic Traded Funds (ETFs)

Grip Invest is a SEBI-regulated OBPP collating non-market-linked investment options. Investors can choose which bonds to invest in thanks to the platform’s comprehensive information on various bonds, including their yield and credit rating. The recent integration of NSE’s Request For Quote (RFQ) with Grip Invest allows investing in corporate bonds as quickly as stocks.

Conclusion

Due to their regular income, benefits of diversification, protection against market volatility, and potential for higher returns than other fixed-income investments, corporate bonds are a valuable addition to an investor’s portfolio. Like any other investment tool, they also come with certain risks. Assessing the investor’s goals and financial capabilities and carrying out due diligence before investing is advisable.

Explore stable corporate bond investment strategies on Grip Invest that can help you achieve your financial goals with curated, rated, SEBI-compliant and listed opportunities.