Rain industries Q4 CY18 review: Business in transition; accumulate on dips

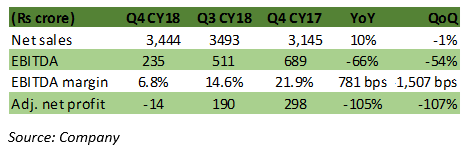

Rain Industries reported a weak set of Q4 CY18 earnings. Its earnings were anticipated to be subdued due to delayed permission to import a key raw material, green petroleum coke (GPC) and a continued import ban of calcined petroleum coke CPC) used for blending key product. But what really caused the disappointment was the adverse impact of high-cost inventory.

Result analysis

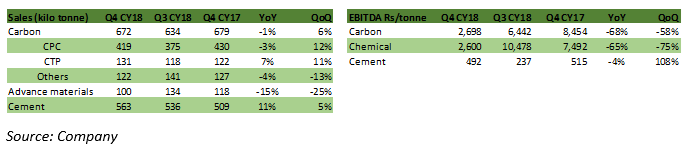

Volume trend in product sales

Key negatives

High-cost inventory continues to impact profitability of most chemical products in carbon (68 percent of total sales) and advance materials (25 percent of total sales) segments. This is attributed to purchase of raw materials when oil derivative prices were elevated.

Recently, some of the finished product prices have declined, which has also contributed to the contraction in EBITDA margin. The company expects a gradual phase out of high-cost inventory and expects normalisation in margin (around 18 percent) towards the end of H1 CY19.

Secondly, given the import ban of CPC, the company is not able to undertake blending in India. This doesn’t augur well for the capacity utilisation of the company’s CPC plant in USA from where it imports. This definitely has an implication for company’s business strategy. The management believes that blending can be done outside India as well but it would take time to transition the business and scout for newer clients.

Thirdly, the company witnessed a decrease in CPC volumes sold due to delay in lifting the ban on GPC import by the Supreme Court.

Read: Adverse SC action has material impact on business model

In addition, the advance materials segment witnessed lower volumes due to sluggish growth in the end-market – European automotive industry – and a rather cautious purchasing by clients at elevated price levels.

Key positives

Revenue in the carbon segment increased 13 percent year-on-year, aided by favourable currency effect and higher blended realisation. Higher volume growth for CTP (around 30 percent of carbon segment sales) were observed due to increased demand from North American aluminium smelters and European graphite industry.

Better realisation was also observed in the advance materials segment — 12 percent YoY, excluding currency impact.

Key observation

The company is undergoing reorganisation of its European operations, closing some operations and pursuing a strategic project in the advance materials segment. On account of these initiatives, the company expects an annual cost saving of $4 million from mid-CY19 onwards.

Outlook

Rain Industries’ business is under transition, wherein a few aspects have a material change on its business strategy. While reorganisation in its European operations is a long-term positive, transition of the CPC blending business is necessitated by regulatory requirements.

The transient impact of high inventory is expected to fade in another three months. Thereafter, the management is hopeful of a sustainable margin profile of about 18 percent.

While the current GPC import quota only covers 72 percent utilisation for the Indian plant, the company is hopeful of optimum utilisation by sourcing Indian GPC and utilising existing inventory. Similarly, the management said the Visakhapatnam expansion plan for CPC is on track and the company would be able to operate even that plant at an optimum level despite the current GPC import quota. Visakhapatnam facility, being under SEZ, also accrues some flexibility to the company in terms of sourcing banned materials.

While we expect next two quarterly results to be subdued, we estimate that it is largely in the price as the stock trades at an inexpensive valuation (five times CY19 estimated earnings). We are encouraged by the fact that business is under mend and carbon product prices are expected to stabilise by mid-CY19. The management expects price stabilisation in the end-market (aluminium) as the current cost of production doesn’t justify aluminium prices.

Two factors which go in its favour, in the context of regulatory challenges, is that it has one of the most stringent environment compliance among carbon companies and its multinational plant presence helps it to make the business transition relatively smoothly.

On account of such factors, we advise accumulating the stock on every decline during the course of the next 3-6 months.

[“source=moneycontrol”]