Exclusive: Sachin Bansal on his investment strategy, his special interest in finance and the sectors he is bullish about

Flipkart co-founder Sachin Bansal, who has turned a devout investor after his exit from the ecommerce company, has turned his attention to the financial services sector.

Bansal recently became CEO of Chaitanya Rural Intermediation Development Services, an NBFC focused on providing microfinance to lower economic groups in rural areas after he acquired a 90 percent stake for more than $100 million.

Bansal, 37, told CNBC-TV18 in an interview that he is looking at a “long-term stint” at Chaitanya India Finance. “Chaitanya is a 10-year-old company with a target of lower-income and rural customers, which will transition into becoming middle class in the next 5-10 years,” he said.

Bansal, an alumnus of the Indian Institute of Technology (IIT) in New Delhi, explained the rationale behind his interest in finance. There is huge under-penetration in the sector, whether it’s a credit-to-GDP ratio or insurance penetration, according to him. “We can give access to a lot more people in financial services. That’s not happening by existing players and technology can be applied to solve this.”

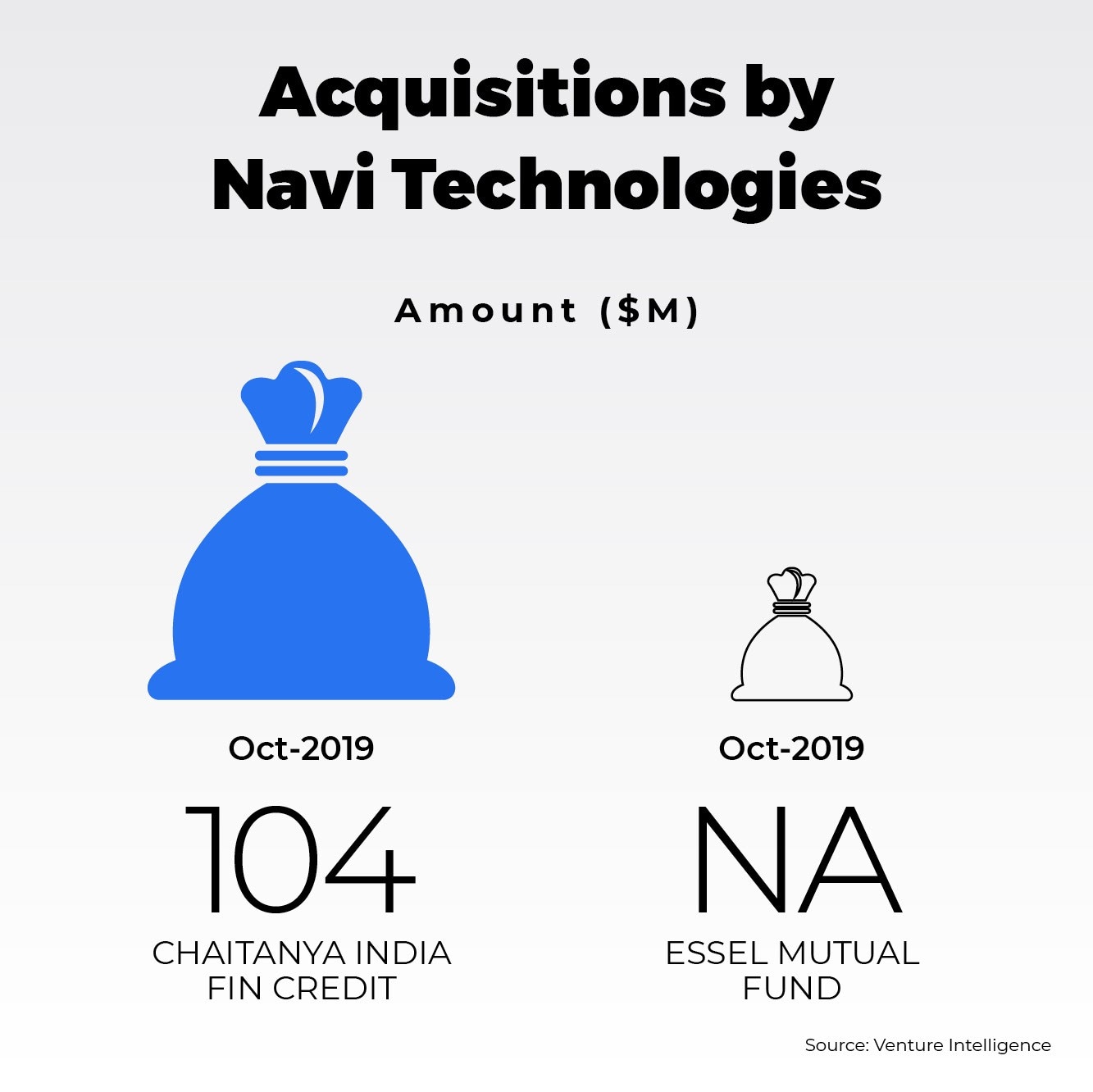

Bansal also formed a company named Navi Technologies to fund startups in the financial sector. He recently invested Rs 888 crore in the company, formerly known as BaCQ.

Sachin Bansal and Binny Bansal, both former Amazon employees, founded Flipkart in 2007. Sachin exited after Walmart bought 77 percent in Flipkart in May 2018.

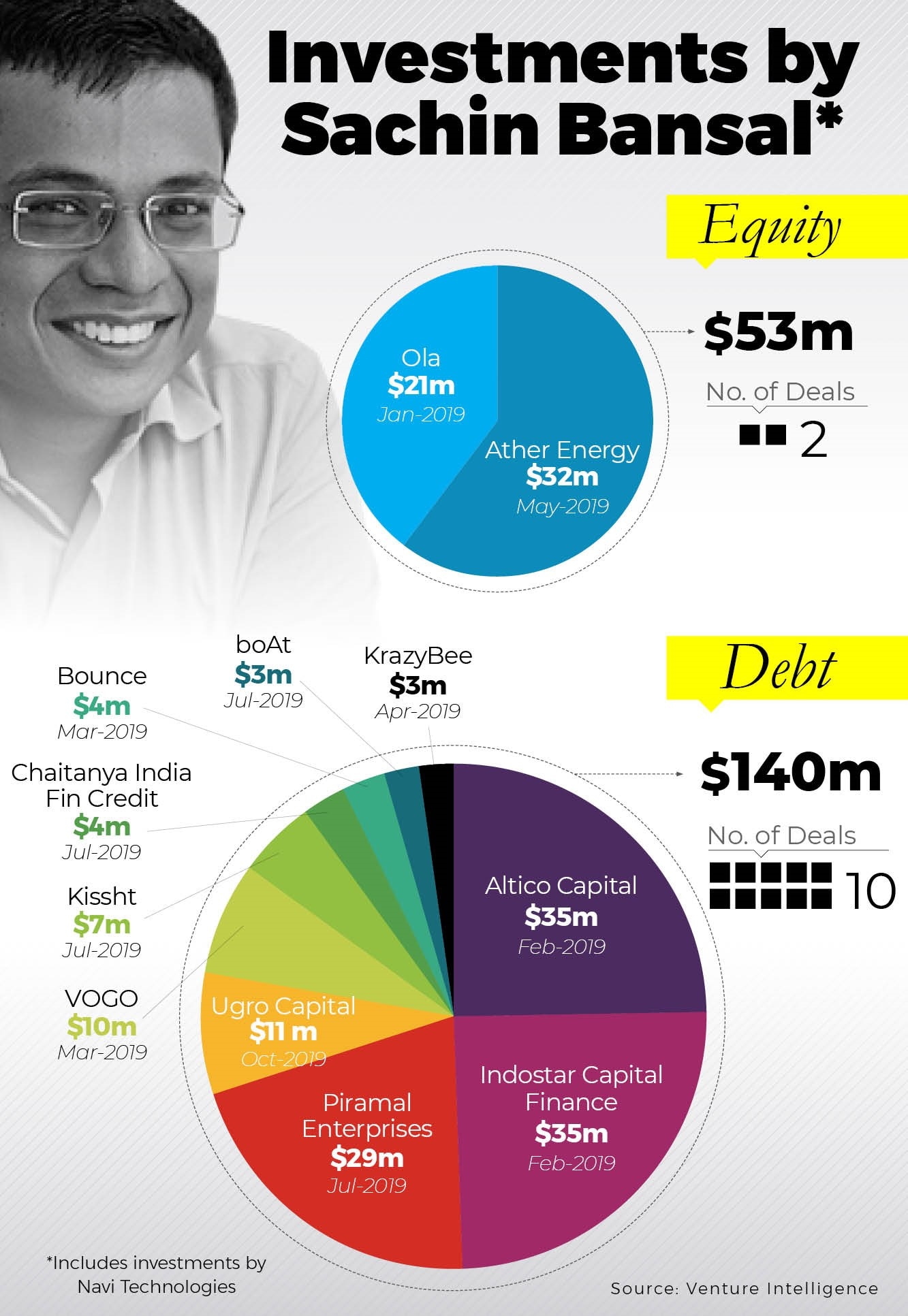

He has accelerated his investments, particularly in finance, since. In 2019 alone, he has made several bets in the financial sector, and besides Chaitanya India Finance, has pumped money into financial players such as Altico Capital, Indostar Capital Finance, U Gro Capital and fintech startups such as Kissht and KrazyBee, according to data from Venture Intelligence.

These investments were both in his personal capacity as well as through Navi Technologies. Bansal also received the green signal from the Competition Commission of India last month to acquire Essel Mutual Fund.

That said, Bansal continues to make personal investments in the mobility sector and other startups. Earlier in the year, he invested $21 million in Ola, and has committed to invest up to Rs 650 crore, or nearly $100 million, in the company. In May, he infused in $32 million in e-scooter maker Ather Energy, a startup he had backed in 2014 as an angel investor.

Industry experts say Bansal’s focus on financial services is backed by his insights on Indian consumers through his experience at Flipkart and the opportunity to disrupt the space with tech.

“He has very deep insights on consumers and small businesses, which is useful when it comes to offering consumer credit and short-term financing,” said Pankaj Karna, founder and MD at Maple Capital Advisors. “Sachin will also have a tech advantage over traditional players in the space,” he added.

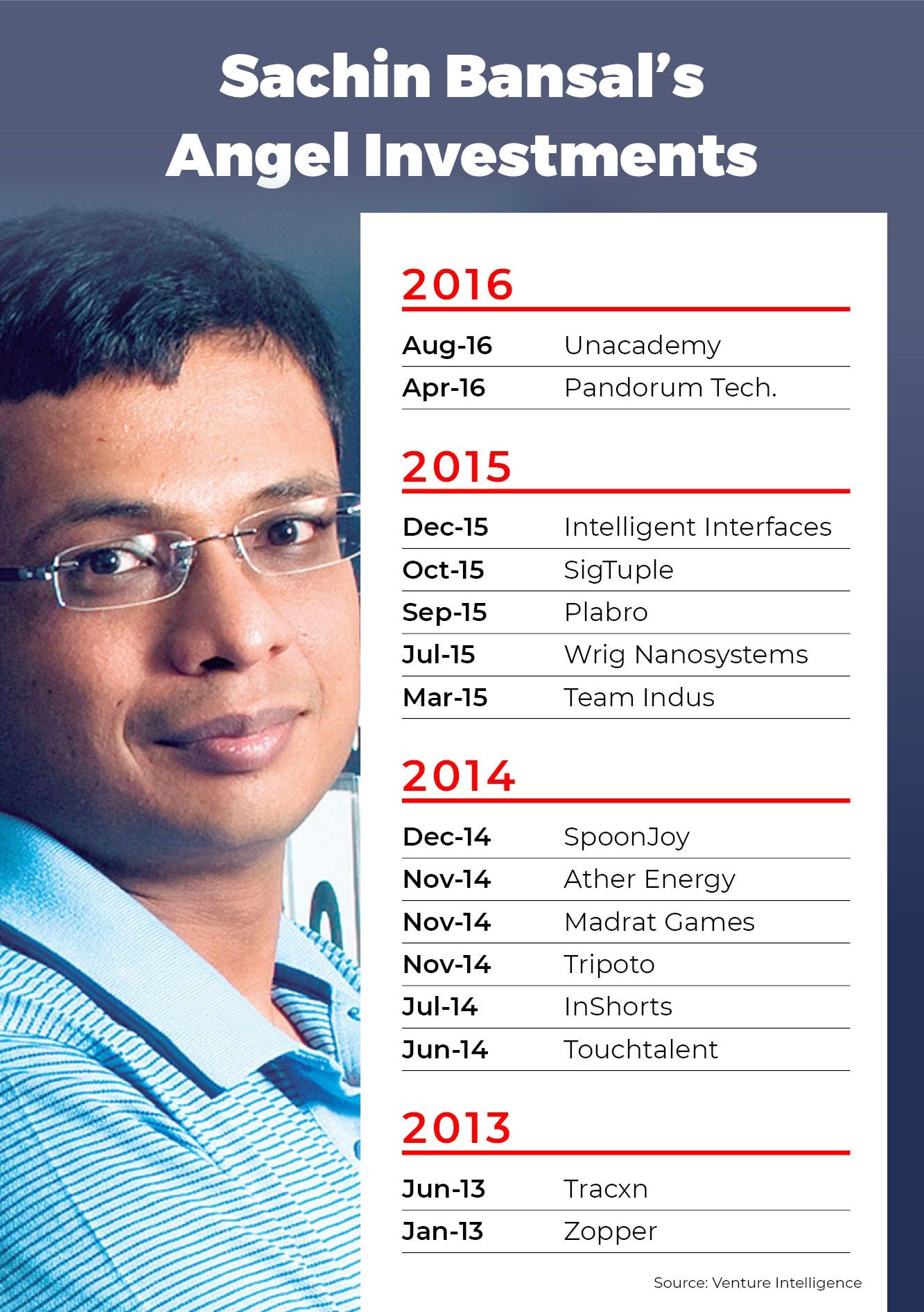

As an angel investor for several years, Bansal has put his money across a raft of sectors. Bansal said he is bullish on transportation, healthcare, and e-commerce.

“Technology hasn’t touched the healthcare sector as much as it can. Transportation will create many unicorns,” Bansal said.

Putting his money where his mouth is, Bansal has made pumped money into the mobility space, including in companies such as Ola, Ather, Bounce, and Vogo.

[“source=cnbctv18”]